Water Heaters (Natural Gas) Tax Credit

Information updated 12/30/2022

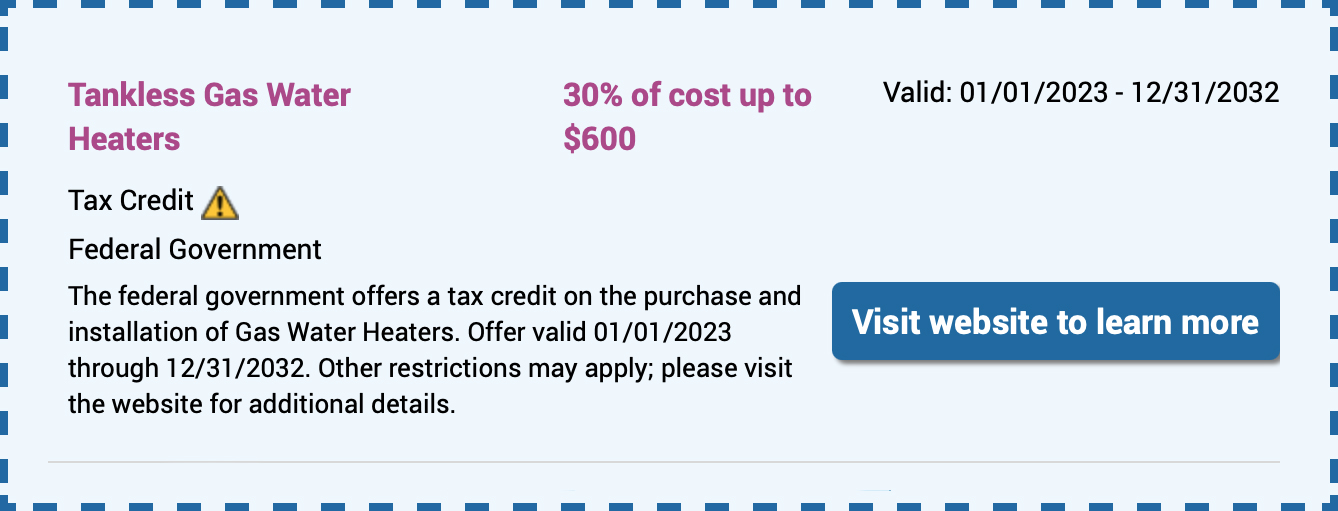

This tax credit is effective for tankless gas water heater and gas storage water heater products purchased and installed between January 1, 2023, and December 31, 2032.

Tankless credits you can claim:

- 30% of project cost

- $600 maximum amount credit

What Products Are Eligible?

Tankless gas water heaters

ENERGY STAR models with > 0.95 UEF are eligible.

Gas storage water heaters

ENERGY STAR certified models are eligible as follows: > 0.81 UEF for tanks less than 55 gallons and > 0.86 UEF for tanks greater than or equal to 55 gallons.

Water heaters that earn the ENERGY STAR come with gas, solar or electric heat pump technology. They heat your water just like standard models but with much less energy, saving up to $3500 over time.

Who can use this credit?

Principal Residence Owners

Must be an existing home & your principal residence. New construction and rentals do not apply.

A principal residence is the home where you live most of the time. The home must be in the United States. It can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home.

About Tankless Water Heater Boulder

We are a Colorado based company and has been serving Boulder, Broomfield, Weld, Denver, Adams, Arapahoe, Douglas, and Jefferson counties since 1997! We are open 7 days a week!

If you are looking for a tankless water heater plumber in Boulder, Longmont, Broomfield, Louisville, Lafayette, Superior, Niwot, Gunbarrel, CO and surrounding areas, we’re here to help!

Every one of our plumbing technicians is experienced and trained in complete plumbing, drain, sewer, and water heater services. No overtime fees and free estimates. There is no charge for on-site estimates when needed.

See what our customers say on Google, Facebook and Yelp.

Call us today at (303) 440-4330 or submit a scheduling request online to schedule your Plumbing service.